“[The stock market is like] an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog’s owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment, there is no predicting which way the pooch will lurch. But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the market players, big and small, seem to have their eye on the dog, and not the owner.”

Those are the words of legendary American investor, Ralph Wagoner. The analogy is clear: in the short-run, there’s really no telling if stocks will go up or down, but through decades of wars, recessions, elections, and revolutions, they have maintained a steady upward trend.

The only problem is us humans are always watching the dog, looking for moments of opportunity or signs of danger. This behaviour seems to be hardwired, and even the biggest and most sophisticated investors fall into the same traps we do.

If you’re worried about the stock market, try repeating these three money mantras (it doesn’t have to be out loud – don’t make it weird).

How long is long? Well, if you’re investing for five years or longer, there have been very few periods with a negative return. If you’re investing for 10 years or longer, there have been virtually no negative results. If you’re investing for 15 years or more, there has never been a period when major North American stock markets did not yield a positive return.

Here’s a picture of the largest U.S. stock market over the past 20 years. Despite the massive tech crash of 2001 and the global financial crisis of 2008, a $10,000 investment back in 1998 would still be worth about $35,000 today. The lesson? Be a long-term investor.

Imagine if you had invested the day before a huge bull market and sold the day before it crashed? Obviously, you’d be rich. But what’s not so obvious is that, even if you didn’t have a crystal ball and all you did was invest a steady amount every month through thick and thin, you’d still be rich.

The reason is something called dollar cost averaging. When you have a plan to invest every month no matter what, you’ll pay more when the market is up, but you’ll get a bargain when the market is down. When you average it all out, you’re going to do just fine.

You could have followed this strategy through all four major stock market crashes since 1972, and you’d have made more than 12 times your money by now. All you have to do is stick to your plan – especially when it feels uncomfortable.

You can’t control which way the market will go or when, but you can sure as heck do something about the investment fees and taxes that eat up more than half of most people’s money. You read that right – more than half.

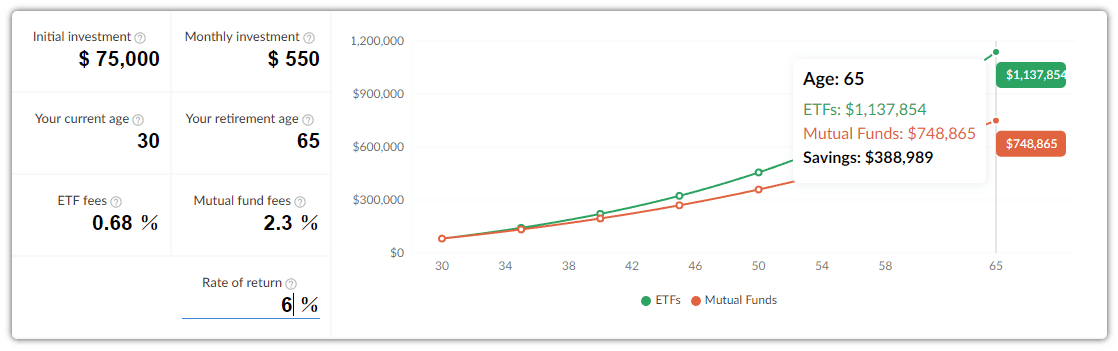

Here’s a snapshot of the growth of a 30-year old’s retirement fund. If she picks mutual funds, she’ll end up with around $700,000. If she chooses low-cost ETFs, she’ll retire with well over $1 million. Want to see how much you could save? Try this handy tool.

When it comes to taxes, you’ve got RRSPs, TFSAs, RESPs and a bunch of other acronyms to help you out. Choose the right ones, in the right proportions, and you could save additional hundreds of thousands of dollars.

The bottom line is this: focus on controlling fees and taxes, and fluctuations in the market will become even less meaningful.

We know, we know. Even if you watch the owner instead of the dog and chant these money mantras religiously, there’s still a deep part of us that freaks out when our investments go down in value. This is perfectly natural, and we’re always here for you if you want to talk about it.

YOUR FREE FINANCIAL PLAN

The best financial plan is also the easiest.

Build your free plan today.

Start now