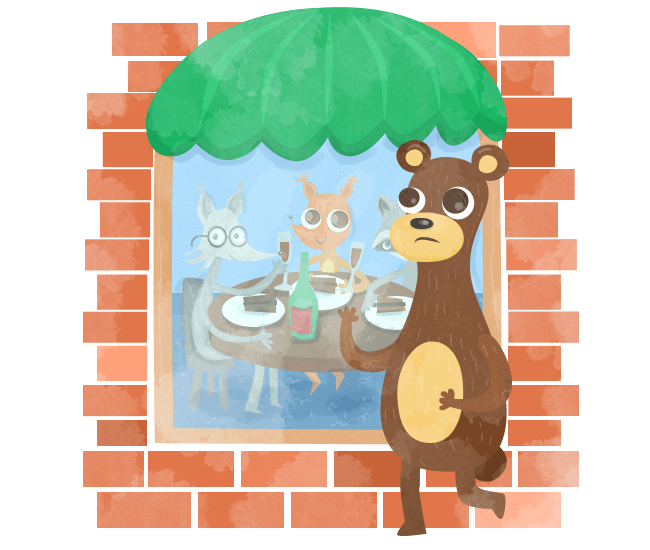

Fear of missing out (FOMO) might be the plight of our Millennial times. We’ve all felt it: While scrolling through Instagram and seeing our friends basking in the sunshine of some beautiful southern locale, in the Snaps we receive from colleagues enjoying after work drinks. It’s so prevalent, so well-known, and so relatable that the Meriam-Webster added it to its list of over 200,000 words in 2016. (For reference: it defines it as “fear of not being included in something — such as an interesting or enjoyable activity — that others are experiencing.”)

But, we didn’t need an official dictionary definition to understand the very real effects of FOMO, both on our mental state and on our wallets.

Giving into every financial impulse is a good way to go broke and leave little money left over to save for the future. So, why not become more mindful of the impact FOMO can have and develop some habits to help you deal with it when it strikes?

Here are five handy tips to get started.

Sure, it sounds ridiculous. But it’s no different than a short-term savings fund – a tried and true method for saving for things like items and trips you’ve been lusting after. Or an emergency fund that allows you to draw cash out in case of, you guessed, emergency.

Stashing a little cash away — aside from your long-term savings — will allow you to dip into it when the feeling to scratch that FOMO itch strikes.

One good place to save is a high interest savings account. They provide a little extra interest (typically up to 2.3%) while also being highly liquid – meaning you can remove the cash whenever your heart desires.

Sit on it for a week. This is more for items than things like trips because, let’s be real, we also feel like we’re missing out on the latest shoes, video games, electronic devices, or whatever our material vice may be.

Whenever that desired item comes out, wait a week before making the purchase. Think of it as a cooling off period that will allow you to truly figure out whether or not you want it. Do you really need the latest iPhone when your eight-month old model is still functioning as well as it did on the day you purchased it?

Use a week to figure that out for yourself.

This is personal finance 101 and can be applied to any purchase. However, FOMO-related ones, in particular, may be the most enticing to put on credit. After all, you likely have access to mounds of it and you can just pay it off next paycheque, right? RIGHT?

Probably not.

And that $500 trip or $200 night out will end up costing a lot more if you don’t pay it off on time and end up accruing interest. So, avoid that and make yourself a promise to only make impulse-related purchases with money you’ve already got.

Rewards credit cards are great. They allow you to accrue points for spending money you otherwise would have anyway. However, it’s important to keep in mind that your balance should always be paid off in full before the deadline to make sure you don’t accrue interest, thus negating all the positives of collecting points.

Two popular rewards type credit cards are travel and cashback cards. Travel points can help you travel sooner and for cheaper and cashback cards can help you earn a little extra cash on purchases you make.

Check out the best travel credit cards in Canada or best cash back credit cards in Canada to see if there’s a card that might help you collect points and start subsidizing your FOMO spending.

Certain cards also offer sign up bonuses, which often include tens of thousands of extra points, to help you reach your goals faster.

Admittedly, budgeting is the least sexy aspect of personal finance. There’s nothing worse than stressing about every dollar you spend and feeling like you’re not able to enjoy your hard-earned money. The truth is, though, that budgeting doesn’t have to be so stressful.

Instead of getting into the nitty gritty of your money management, and allotting a certain amount of money to each spending category (such as clothes, food, entertainment), why not give the 50/30/20 budgeting rule a try?

How it works is simple: Allocate 50% of your after-tax income to needs (bills, rent, mortgage, etc.); 30% to wants (entertainment, dining out, scratching the FOMO itch), and 20% to savings.

Automate your savings and bill payments and track your discretionary spending. Don’t feel guilty about spending on your wants – as long as you stay within your 30% budget. This may take some planning; be honest with yourself when it comes to the impact FOMO has on you, and plan for those moments when you will feel the overwhelming need to join your friends for a night out on the town.

And, if that particular night out will put you over the 30% budget, practice self-control and just say no.

None of us want to miss out on the exciting moments in life. We don’t want to spend our days worrying about the impact going out and having fun with our friends will have on our finances. But we need to practice some self-control and develop habits that allow us to enjoy life and make smart financial decisions.

Hopefully some of these tips will help you feel better next time you cave to FOMO in your own life.

YOUR FREE FINANCIAL PLAN

Are you ready to invest in your future?

Build your free plan today.

Start now