Housing affordability has long been a key issue for Canadians, and one that governments of all levels have tried to address; both provincial and federal leadership have introduced a slew of policy changes and taxes over the last few years, designed to cool prices in the nation’s largest markets (take a look at Vancouver homes for sale and the Toronto MLS to see the current state of the market).

However, while those measures may have effectively chilled sales – the latest report from the Canadian Real Estate Association reveals activity fell to a 10-year low for February, down 4.4% from the year before – the gap between real estate prices and incomes remains too wide for many prospective buyers to straddle. That’s led to growing pressure on the federal government to take additional action, addressed in the latest 2019 Federal Budget.

However, the jury is still out on whether new measures would actually improve affordability for Canadians; according to a recent survey conducted by Zoocasa, while 82% of respondents feel the cost of housing remains a major issue, 55% don’t believe it can be fixed via government policies alone. As well, an additional 21% don’t feel any real positive change will be possible over the next five years.

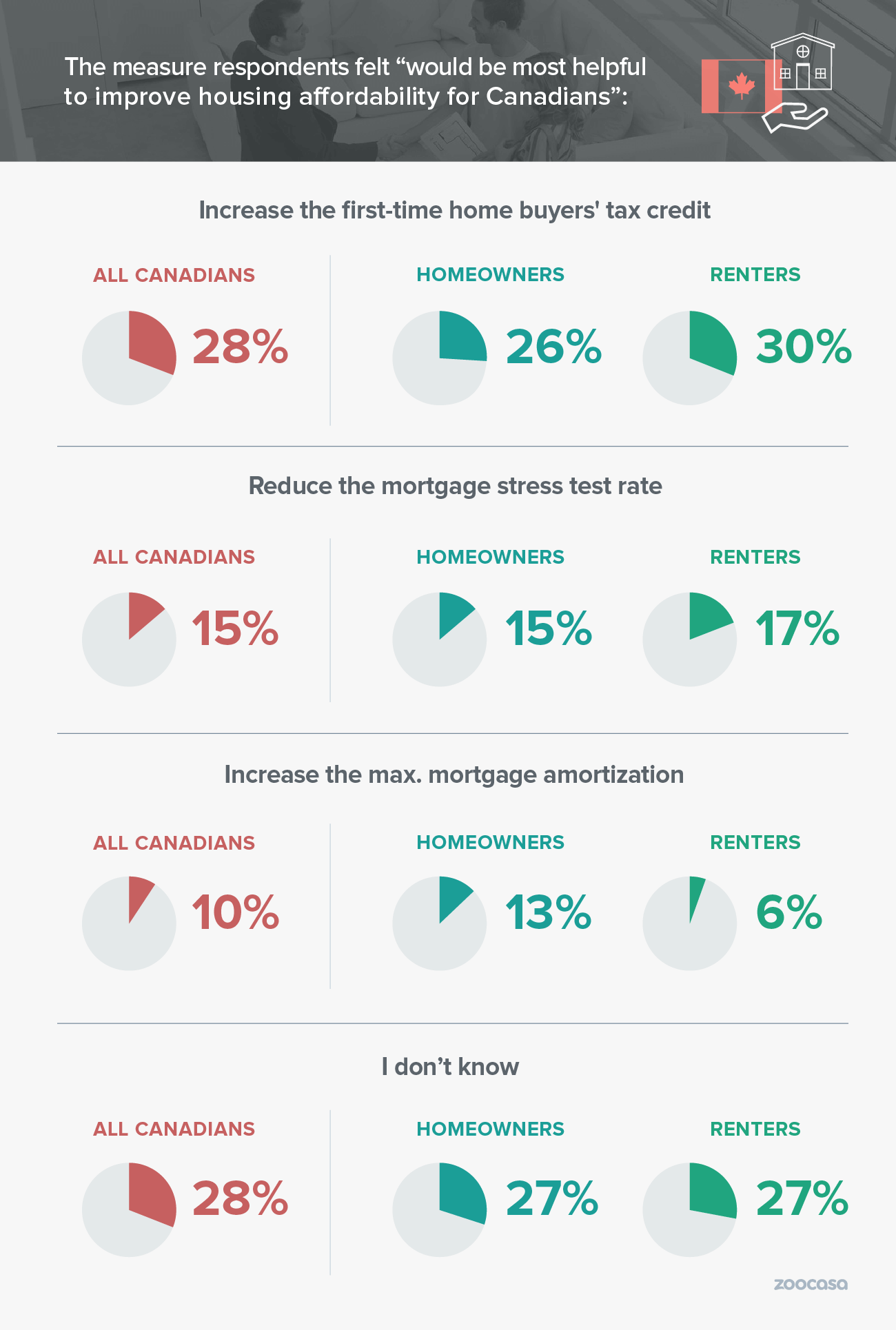

The survey also revealed what measures Canadians would most like to see included in the Budget to improve housing affordability – and it came down to more cash in hand. The largest percentage, 28%, indicated they’d most like to see an expansion to the federal First Time Home Buyers’ Tax Credit, which currently pays out up to $750 to buyers who claim up to $5,000 of their home purchase on their taxes.

Surprisingly, Canadians were also less likely to point to the national mortgage stress test as a factor behind affordability challenges. Put in place in January 2018 as a way to stem risky borrowing practices, the test requires borrowers of new and refinanced mortgages to prove they can afford their regular mortgage payments at an interest rate roughly 2% higher than the one they’ll actually receive from their lender. While the stress test has been widely criticized by real estate bodies for reducing buyers’ purchasing power and over-cooling smaller markets, only 15% of respondents felt reducing its rate would aid in improving home affordability.

Another point of focus is the length of mortgage amortizations for first-timers, and whether they’d benefit from an extension to 30 years from the existing 25, which is required for buyers paying less than 20% down on their home purchase. A number of boards, including the Toronto Real Estate Board and British Columbia Real Estate Association, have called for this measure to be put into place, as doing so would reduce the size of monthly mortgage payments which in turn would make it easier to satisfy the stress test’s requirements. However, only 10% of respondents indicated this would be a desired outcome.

Check out the infographic below to see which housing affordability measures Canadians would most like to see:

YOUR FREE FINANCIAL PLAN

The best financial plan is also the easiest.

Build your free plan today.

Start now